600215股票行情

Title: Understanding Stock Investments and 401(k) Retirement Plans

Investing in stocks through a 401(k) retirement plan can be a smart way to build wealth over time while saving for retirement. Let's delve into the essentials of both topics.

Stock Investments:

Stocks represent ownership in a company. When you buy stocks, you essentially buy a share of that company's ownership. The value of your investment can rise or fall based on the performance of the company and overall market conditions.

Types of Stocks:

1.

Common Stocks:

These give shareholders voting rights in the company's decisions and offer the potential for capital appreciation through price increases and dividends.

2.

Preferred Stocks:

Preferred shareholders typically receive fixed dividends but have limited or no voting rights.3.

Bluechip Stocks:

Stocks of wellestablished, financially stable companies with a history of reliable performance are considered bluechip stocks. They are often less volatile than other types of stocks.4.

Growth Stocks:

These stocks belong to companies expected to grow at an aboveaverage rate compared to other companies. They may not pay dividends but offer the potential for significant capital appreciation.5.

Value Stocks:

Value stocks are undervalued relative to their fundamentals, such as earnings or assets. Investors buy them in the hope that the market will recognize their true value over time.Risk and Return:

Stock investments carry risks, including the potential for loss of principal. However, they historically offer higher returns over the long term compared to other asset classes like bonds or cash equivalents. It's essential to diversify your stock portfolio to mitigate risks.

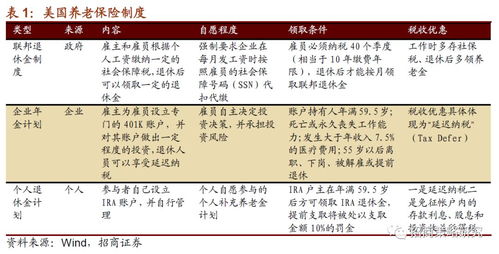

401(k) Retirement Plans:

A 401(k) is a taxadvantaged retirement savings plan offered by many employers in the United States. Here's how it works:

1.

Employee Contributions:

Employees can contribute a portion of their pretax income to their 401(k) accounts, reducing their taxable income for the year. Some employers also offer Roth 401(k) options, where contributions are made with aftertax dollars but withdrawals in retirement are taxfree.2.

Employer Matching:

Many employers offer matching contributions, where they match a portion of the employee's contributions, up to a certain percentage of the employee's salary. This is essentially free money and can significantly boost retirement savings.3.

Investment Options:

401(k) plans typically offer a range of investment options, including stocks, bonds, mutual funds, and targetdate funds. Employees can choose their investments based on their risk tolerance and retirement goals.4.

Tax Benefits:

Investments in a traditional 401(k) grow taxdeferred, meaning you don't pay taxes on dividends, interest, or capital gains until you withdraw the money in retirement. Roth 401(k) contributions offer taxfree withdrawals in retirement.Guidelines for Maximizing 401(k) Benefits:

1.

Start Early:

The power of compounding works best over time. The earlier you start contributing to your 401(k), the more you can potentially accumulate by retirement age.2.

Contribute Enough to Get the Full Employer Match:

Aim to contribute at least enough to receive the maximum employer match, as it's essentially free money that accelerates your retirement savings.3.

Diversify Your Investments:

Spread your contributions across different asset classes to reduce risk. Consider your risk tolerance and investment horizon when choosing investments.4.

Regularly Review and Rebalance:

Periodically review your 401(k) investments to ensure they align with your retirement goals. Rebalance your portfolio if necessary to maintain your desired asset allocation.In conclusion, investing in stocks through a 401(k) retirement plan can be a powerful strategy for building wealth over the long term. Understanding the basics of stocks, the workings of a 401(k) plan, and implementing sound investment principles can help you achieve your retirement goals.

股市动态

MORE>- 搜索

- 最近发表

-

- 沈阳医保二次报销,守护健康,减轻负担的双重盾牌

- 恒马金融,金融科技的创新先锋

- 百股跌停,股市风暴中的黑色星期五

- 上海医药集团,健康生活的守护者

- 银华金利,探索中国金融创新的璀璨明珠

- 美元汇率查询,掌握全球经济脉搏,洞察投资先机

- 木林森股份,探索中国LED照明行业的领军企业

- 股票300142,探秘沃森生物,解锁生物科技的财富密码

- 柳钢股份股吧,投资者的交流平台与信息宝库

- 通化金马股吧,投资者的交流平台与信息集散地

- 成都金宇集团,西南经济的璀璨明珠成都

- 探索和讯黄金网,黄金投资的数字化时代

- 雷亚尔对人民币汇率,理解货币兑换的艺术

- 长江电力股份,能源巨轮,照亮未来

- 探索福州市房产交易中心,房产交易的桥梁与指南

- 深入解析基金000001,投资小白的入门指南

- 高盟新材股票,分析、前景与投资建议

- 亚夏汽车股票,投资潜力与市场前景分析

- 深入解析,保险代理人资格证的重要性与获取路径

- 海王英特龙,探索深海的神秘生物